What Are Medicare Advantage Plans and How Do They Work?

Hey there! Today, let’s dive into the world of Medicare Advantage Plans, or as they’re sometimes known, Medicare Part C. If you've been navigating the maze of Medicare options, you've likely come across these plans, which promise an all-in-one solution to your healthcare needs. But what exactly are they, and how do they work? Let’s break it down in a casual, conversational way.

The Basics of Medicare Advantage Plans

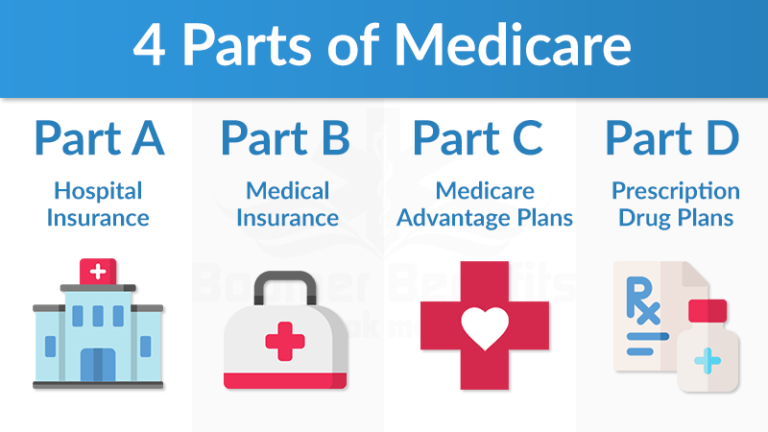

First things first, Medicare Advantage Plans are an alternative to Original Medicare, offered by private insurance companies but approved by Medicare. These plans bundle Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and often include Medicare Part D (prescription drug coverage) as well.

Think of it as a combo meal at your favorite restaurant. Instead of ordering your burger, fries, and drink separately, you get them all together. Medicare Advantage Plans work similarly, offering a packaged deal that covers most of the healthcare services you might need.

Why Choose Medicare Advantage?

One of the key attractions of Medicare Advantage Plans is the additional benefits they can offer. Many plans include benefits that aren't covered by Original Medicare, such as vision, hearing, dental care, and even gym memberships. So, not only do you get the traditional coverage, but also these extra perks that can make a big difference in your quality of life.

For many people, the convenience of having all their Medicare benefits under one plan is a huge plus. It simplifies things, which is always a welcome relief when dealing with healthcare. Also, these plans often have a network of doctors and facilities that agree to treat patients at negotiated rates, which can potentially lower your out-of-pocket costs.

Understanding the Coverage

Coverage details can vary widely from one Medicare Advantage Plan to another, which is why it's crucial to shop around. Each plan has its own list of covered services and its own rules for how you get services. For example, some plans might require you to get a referral to see a specialist, while others may not.

Most Medicare Advantage Plans also include prescription drug coverage, which is not typically covered by Original Medicare. This bundled approach can make managing medications much simpler since everything is under one roof.

Costs of Medicare Advantage Plans

Discussing costs, Medicare Advantage Plans can be a mixed bag. Some plans offer $0 premiums (yes, $0!), but don’t let that number fool you. It’s important to look at the big picture, including deductibles, copays, and coinsurance. Each plan sets its own terms, and they can vary quite a bit.

Also, while you pay a premium for Original Medicare, you might also pay an additional premium for your Medicare Advantage Plan. The good news is that there's a cap on out-of-pocket expenses for Part A and B services, which Original Medicare doesn't provide. Once you hit that cap, you won’t pay anything for covered services for the rest of the year.

Choosing the Right Plan for You

So, how do you choose the right Medicare Advantage Plan? It starts with understanding your health needs and your budget. Here are a few tips:

- List your needs: Consider what kind of healthcare services you use regularly, what medications you take, and whether you prefer specific doctors or hospitals.

- Compare plans in your area: Benefits can vary based on where you live, so use the Medicare Plan Finder on Medicare’s website to see what’s available near you.

- Check the network: If you have preferred doctors or hospitals, make sure they are in the plan’s network.

- Understand all costs: Don’t just look at premiums. Consider deductibles, copays, and the out-of-pocket maximum.

Switching Plans

If you find that a plan doesn’t quite fit your needs, or your needs change, Medicare Advantage Plans offer flexibility to switch during specific times of the year. The Annual Election Period (from October 15 to December 7 every year) allows you to switch plans or return to Original Medicare. Plus, there's the Medicare Advantage Open Enrollment Period (from January 1 to March 31) where if you're already enrolled in a Medicare Advantage Plan, you can switch to a different Medicare Advantage Plan or go back to Original Medicare.

Wrapping Up

Medicare Advantage Plans offer a potentially beneficial alternative to Original Medicare, especially if you're looking for broader coverage and extra benefits. However, they require a bit of homework to ensure you get the right fit for your healthcare needs and financial situation. Remember, every person's needs are different, so what works for your neighbor might not be the best choice for you.

Ready to dive deeper into your Medicare options? Start by assessing your needs and comparing plans in your area. Your health is worth that extra bit of effort!